georgia estate tax calculator

It is sometimes referred to as a death tax Although states may impose their own. Property Taxes in Georgia.

:max_bytes(150000):strip_icc()/beautiful-old-couple-619409150-d7a3f4b5f2874a55a0195b8c53d9d3b9.jpg)

Calculating Your Potential Estate Tax Liability

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Our calculator has recently been updated to include both the latest Federal Tax. 48-5-7 Property is assessed at the county level by the Board of Tax.

Georgia Estate Tax Calculator. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in Cherokee County is.

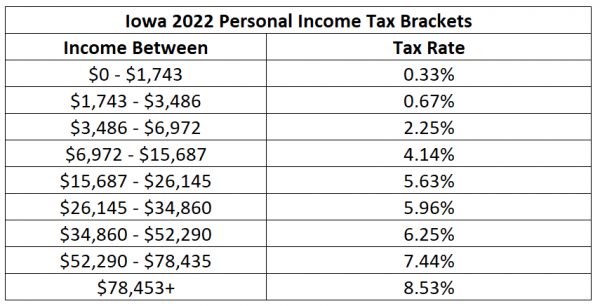

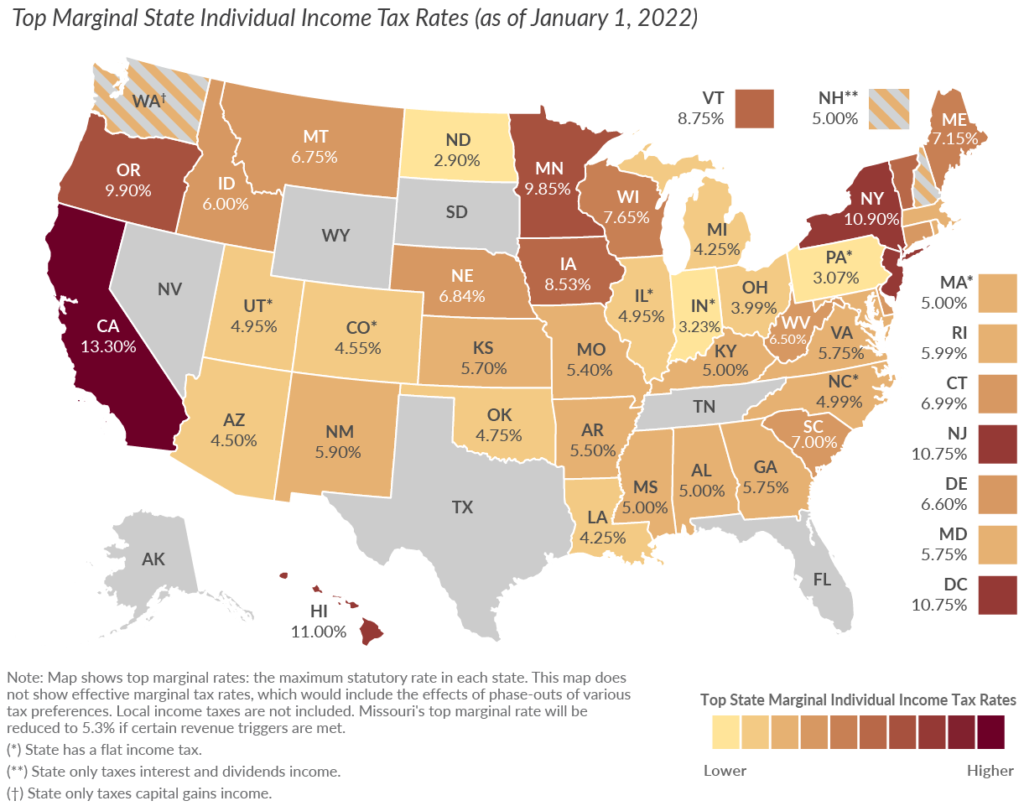

You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 202223. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. However because Georgias highest income bracket tops out at 7000 10000 if married filing jointly per year the vast majority.

Property Tax Homestead Exemptions. To calculate the exact property tax saving a Southbridge property owner would realize if annexed into Garden City enter your property value into the box below. An estate tax is a tax imposed on the total value of a persons estate at the time of their death.

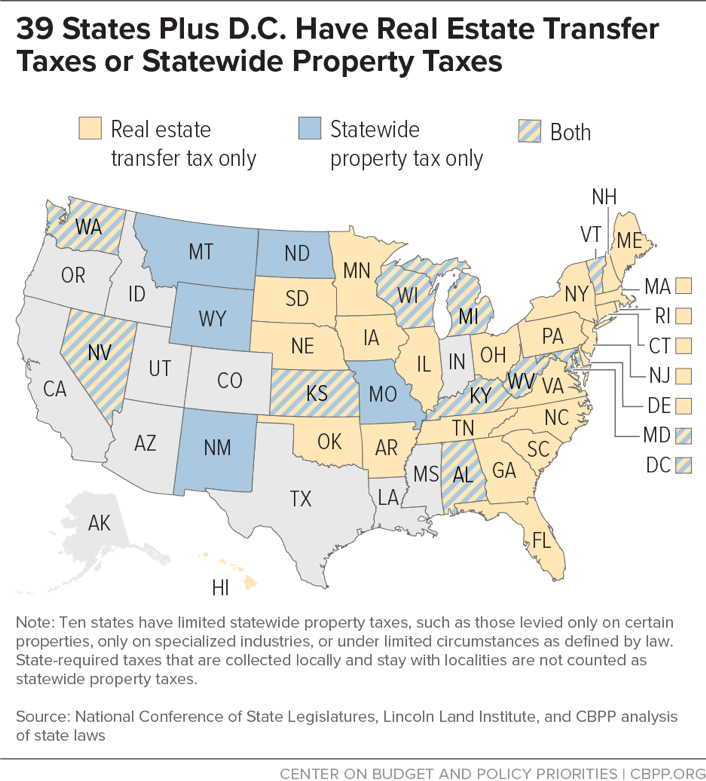

The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. One of the biggest considerations in reaching this goal is the federal estate tax.

Some areas do not have a county or local transfer tax rate. For comparison the median home value in Georgia is 16280000. This means the higher your income the higher your tax rate.

For comparison the median home value in Habersham County is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Property Tax Returns and Payment.

Seller Transfer Tax Calculator for State of Georgia. For comparison the median home value in Fulton County is. County Property Tax Facts.

Garden City GA 100 Central. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza. For comparison the median home value in Paulding County is.

In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law. This calculator can estimate the tax due when you buy a vehicle.

What Is The U S Estate Tax Rate Asena Advisors

Property Tax Calculator Estimator For Real Estate And Homes

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

![]()

Estate Tax Calculator Estate Tax Liability Planning Jackson Hewitt

North Carolina Estate Tax Everything You Need To Know Smartasset

Property Tax Calculator Estimator For Real Estate And Homes

Georgia Property Tax Calculator Smartasset

Moving States And Tax Residency Considerations Anchor Capital Advisors

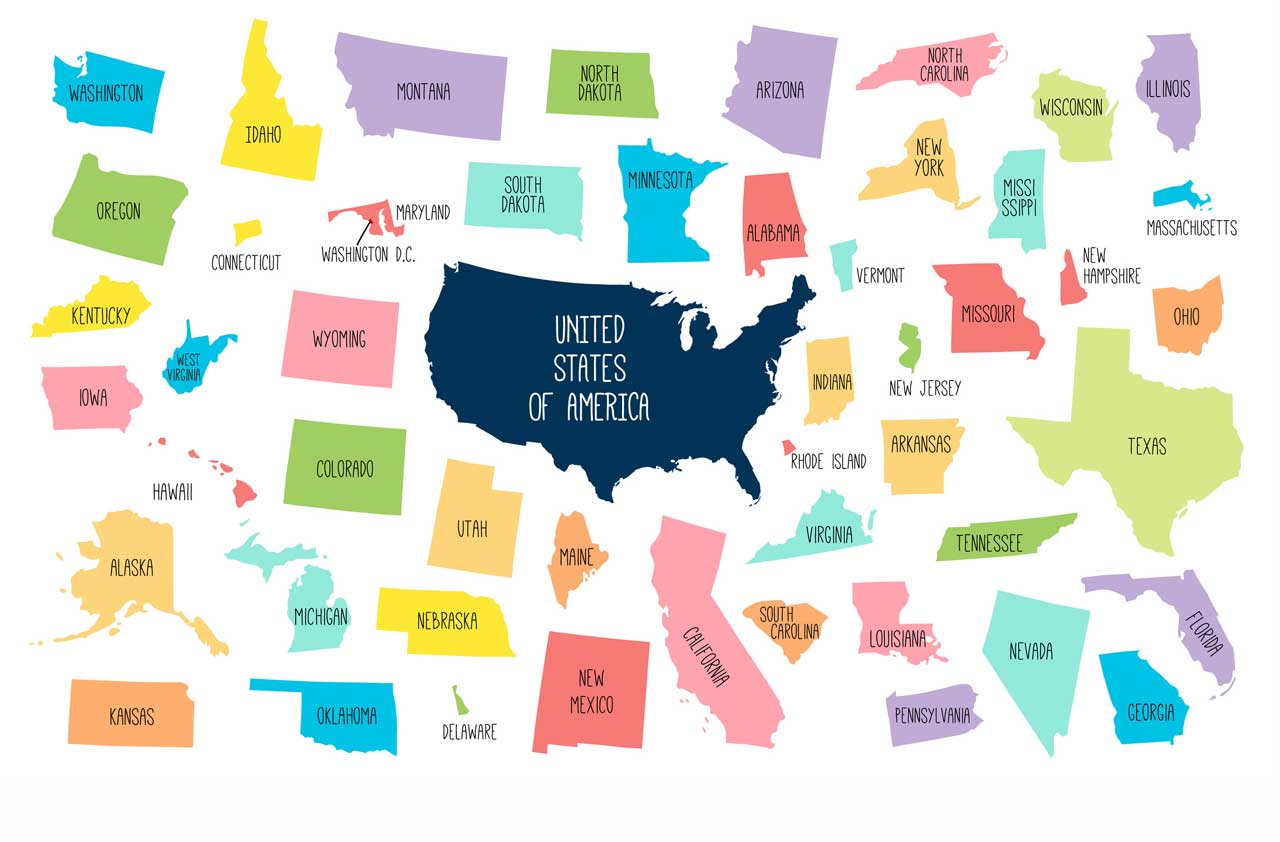

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Irs Announces 2019 Tax Rates Standard Deduction Amounts And More

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

General Sales Taxes And Gross Receipts Taxes Urban Institute

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Georgia Estate Law Faulkner Law

Georgia Estate Tax Everything You Need To Know Smartasset

State Tax Levels In The United States Wikipedia

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger