do nonprofits pay taxes on donations

There are more than 25 types of. Donor Acknowledgment Letters What To Include The IRS automatically considers certain types of nonprofits as tax-exempt so theres no need to.

Your Crypto Taxes Can Be Donated To Charity Instead

Do 501c3 pay taxes on donations.

. Nonprofit Organizations for Sales and Use Income and Withholding Taxes Revised December 2009 INFORMATION 7-215-1992 Rev. Your recognition as a 501c3 organization exempts you from federal income tax. They must pay business and occupation BO tax on gross revenues generated from regular business.

Tax Information on Donated Property. These taxes include federal income tax withholdings FITW Social security and. Do nonprofit organizations have to pay taxes.

Do non profits file tax returns. The research to determine whether or not sales. We recognize that understanding tax issues related to your organization can be time-consuming and complicated.

We want to help you get the information. Most nonprofits fall into the 501c3 category and this is the category that offers the most tax benefits. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

Even though most tax-exempt nonprofit organizations do not pay federal taxes that is what tax-exempt means most do have to file. The federal tax code allows individuals and businesses to make noncash contributions to qualifying charities and to claim deductions for. 12-2009 Supersedes 7-215-1992 Rev.

Do nonprofits pay taxes. Do nonprofits pay payroll taxes. Nonprofit Organizations for Sales and Use Income and Withholding Taxes Revised December 2009 INFORMATION 7-215-1992 Rev.

In Washington nonprofit organizations are generally taxed like any other business. However this corporate status does not automatically. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

Nonprofits that qualify for 501c3. Gift taxes are the. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

Yes even tax-exempt nonprofit organizations must pay the usual payroll taxes for employees. An essential thing to remember about earned income is that it must directly contribute to the nonprofits mission to maintain its tax-exempt status. Do Nonprofits Pay Taxes.

Do 501c3 pay taxes on donations.

The Irs Encourages Taxpayers To Consider Charitable Contributions Internal Revenue Service

Stay On Track With This Schedule For Nonprofit Accounting Altruic Advisors

How To Pay Your Nonprofit Staff

Nonprofit Accounting Basics Taxes Donations And More Paychex

Why Should I Donate To A Nonprofit Organization Student Advice Collegian Psu Edu

5 Nonprofit Fundraising Laws You Should Know About

A Sample Chart Of Accounts For Nonprofit Organizations Altruic Advisors

Do Nonprofits Pay Taxes Do Nonprofit Employees Pay Taxes Blue Avocado

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

How Nonprofits Can Use Social Media To Increase Donations And Boost Visibility

Who Benefits From The Deduction For Charitable Contributions Tax Policy Center

Do Nonprofits Pay Payroll Taxes Your Questions Answered

Accepting Cryptocurrency Donations In 2022 Complete Guide For Nonprofits

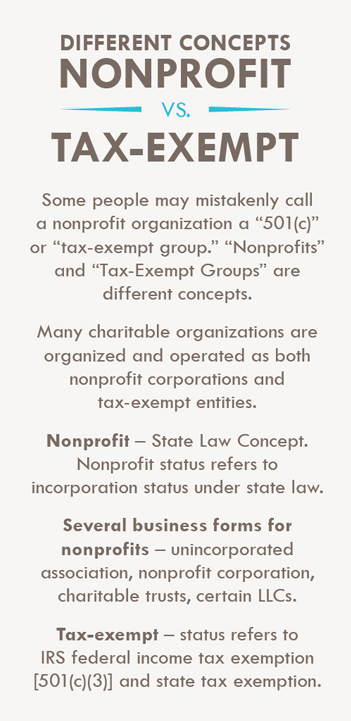

What Is The Difference Between Nonprofit And Tax Exempt

The Nonprofit Guide To Facebook Donation Tax Receipts

How To Donate Property To A Nonprofit And Save On Your Taxes The Giving Block

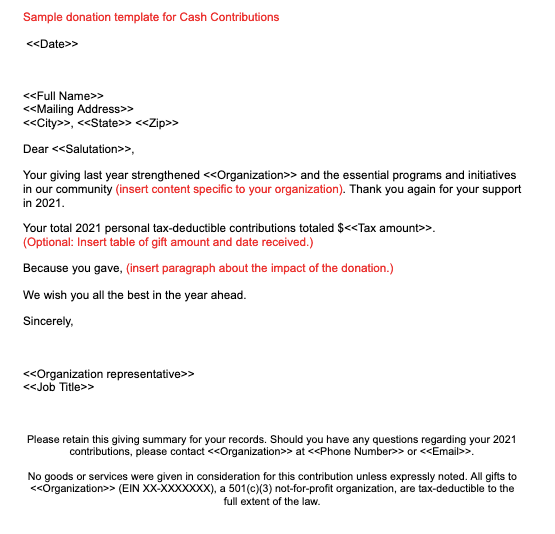

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox